How to Purchase Reverse Mortgage and Improve Your Quality of Life

How to Purchase Reverse Mortgage and Improve Your Quality of Life

Blog Article

Step-By-Step: Just How to Acquisition a Reverse Home Loan With Confidence

Navigating the intricacies of acquiring a reverse mortgage can be complicated, yet a methodical method can empower you to make informed choices. It begins with evaluating your eligibility and understanding the subtleties of different funding choices offered out there. Involving with respectable lenders and contrasting their offerings is vital for protecting beneficial terms. Nevertheless, the process does not finish there; careful focus to paperwork and conformity is crucial. As we explore each action, it ends up being evident that self-confidence in this financial choice depends upon comprehensive preparation and notified selections. What follows in this essential trip?

Understanding Reverse Mortgages

The primary device of a reverse mortgage involves loaning versus the home's value, with the funding amount enhancing in time as interest accrues. Unlike traditional home mortgages, consumers are not needed to make regular monthly payments; instead, the car loan is paid back when the homeowner markets the building, leaves, or passes away.

There are 2 major kinds of reverse home loans: Home Equity Conversion Mortgages (HECM), which are government insured, and exclusive reverse home loans provided by private lending institutions. HECMs commonly offer greater defense because of their governing oversight.

While reverse home loans can offer monetary alleviation, they likewise feature costs, including origination charges and insurance premiums. It is essential for potential borrowers to completely comprehend the terms and implications prior to continuing with this economic alternative.

Assessing Your Eligibility

Qualification for a reverse home mortgage is largely established by several crucial variables that potential borrowers should take into consideration. Applicants need to be at the very least 62 years of age, as this age demand is set to ensure that borrowers are approaching or in retirement. Additionally, the home must serve as the borrower's key residence, which implies it can not be a getaway or rental residential or commercial property.

One more vital element is the equity position in the home. Lenders usually need that the consumer has an enough quantity of equity, which can impact the amount available for the reverse home mortgage. Usually, the more equity you have, the bigger the financing amount you might qualify for.

Additionally, potential borrowers have to show their ability to meet economic commitments, including real estate tax, homeowners insurance, and maintenance expenses - purchase reverse mortgage. This assessment often consists of a monetary assessment performed by the loan provider, which evaluates earnings, credit report, and existing financial obligations

Lastly, the building itself should fulfill certain requirements, including being single-family homes, FHA-approved condos, or certain manufactured homes. Recognizing these elements is crucial for figuring out qualification and getting ready for the reverse mortgage procedure.

Researching Lenders

After identifying your qualification for a reverse home loan, the following step includes looking into lending institutions who use these economic items. It is vital to identify credible lending institutions with experience in reverse mortgages, as this will guarantee you get trusted guidance throughout the procedure.

Begin by assessing lending institution credentials and certifications. Search for loan providers that are participants of the National Opposite Mortgage Lenders Organization (NRMLA) and are accepted by the Federal Real Estate Management (FHA) These associations can show a dedication to moral practices and compliance with industry standards.

Reading customer reviews and reviews can offer insight into the lender's credibility and customer care quality. Web sites like the Better Organization Bureau (BBB) can additionally provide ratings and issue histories that may aid educate your decision.

Furthermore, talk to monetary consultants or housing therapists who concentrate This Site on reverse home loans. Their proficiency can help you navigate the alternatives offered and advise trustworthy lending institutions based upon your special economic circumstance.

Comparing Loan Choices

Contrasting car loan choices is a vital action in protecting a reverse mortgage that lines up with your economic goals. When assessing different reverse home loan items, it is important to consider the certain attributes, expenses, and terms linked with each option. Begin by evaluating the kind of reverse mortgage that ideal fits your requirements, such as Home Equity Conversion Home Mortgages (HECM) or proprietary fundings, which might have various qualification criteria and benefits.

Following, take notice of the passion prices and costs connected with each car loan. Fixed-rate finances give stability, while adjustable-rate site alternatives might use lower initial prices but can fluctuate in time. In addition, think about the in advance expenses, consisting of mortgage insurance policy costs, source costs, and closing prices, as these can considerably influence the overall cost of the finance.

Furthermore, examine the payment terms and how they straighten with your long-lasting economic strategy. When the loan must be paid off is essential, understanding the effects of how and. By thoroughly comparing these variables, you can make an educated choice, ensuring your option supports your monetary well-being and provides the safety you look for in your retirement years.

Settling the Purchase

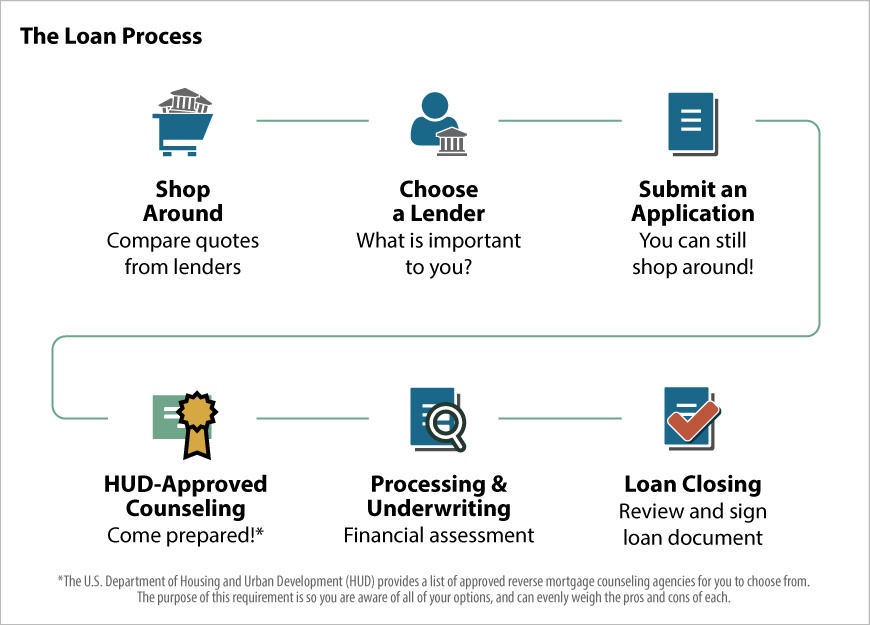

When you have actually thoroughly assessed your choices and selected the most suitable reverse mortgage product, the next action is to wrap up the purchase. This procedure involves numerous vital steps, making certain that all necessary paperwork is properly completed and submitted.

First, you will certainly require to gather all needed documentation, including proof of earnings, residential or commercial property tax obligation declarations, and home owners insurance policy paperwork. Your lender will offer a list of certain records required to facilitate the approval procedure. It's critical to provide total and accurate information to avoid delays.

Next, you will go through a detailed underwriting process. During this phase, the lender will certainly evaluate your financial circumstance and the value of your home. This might consist of a home assessment to figure out the home's market worth.

As soon as underwriting is complete, you will certainly receive a Closing Disclosure, which outlines the last regards to the car loan, including charges and passion prices. Evaluation this file thoroughly to ensure that it aligns with your expectations.

Verdict

Finally, browsing the process of acquiring a reverse home loan requires a detailed understanding of eligibility requirements, attentive study on lenders, and careful contrast of finance choices. By methodically following these actions, individuals can make educated decisions, guaranteeing that the chosen home loan aligns with economic objectives and needs. Ultimately, a knowledgeable approach promotes self-confidence in safeguarding a reverse home loan, providing economic security and support for the future.

Look for loan providers that are members of the National Reverse Mortgage Lenders Organization (NRMLA) and are accepted by the Federal Real Estate Administration (FHA)Comparing funding options is a crucial step in safeguarding a reverse mortgage that lines up with your financial goals (purchase reverse mortgage). Beginning by this post examining the type of reverse mortgage that finest suits your demands, such as Home Equity Conversion Mortgages (HECM) or exclusive car loans, which may have different eligibility standards and benefits

In conclusion, navigating the process of buying a reverse mortgage needs a complete understanding of qualification criteria, thorough research on lending institutions, and mindful comparison of lending choices. Ultimately, an educated strategy cultivates self-confidence in securing a reverse home loan, offering monetary security and assistance for the future.

Report this page